Loan Application

| Applicant Name | |

| CNIC | |

| Mobile | |

| Loan Type | |

| Loan Amount | |

| Loan Period | |

| Registration Fee | Rs 5,600 |

| Status | PENDING |

| CNIC | |

| Loan Amount | Rs 3,000,000 |

| Registration Fee | Rs 5,600 |

| Status |

Loan Application Status

Akhuwat Interest-Free Loan Program

How We Support You

A simple, transparent and trust-based guidance system

Eligibility Check

We first review basic information to understand whether you qualify for support before moving forward.

Learn how it worksSimple Information

Only essential details are required so the process remains easy, clear and stress-free.

View requirementsStep-by-Step Review

Each request is carefully reviewed to ensure fairness, transparency and proper guidance.

Our review processPersonal Guidance

Our support team stays available to guide you at every stage with clear communication.

Contact supportPrivacy & Trust

Your information is handled responsibly with care, respect and confidentiality.

Our commitmentCommunity Focused

Our goal is to support individuals and families through ethical and community-based initiatives.

About our missionAkhuwat Loan 2026

Akhuwat Foundation Loan 2026 is one of the most trusted interest-free loan schemes in Pakistan, providing financial support to low-income individuals and small business owners. Through its Qarz-e-Hasna program, Akhuwat Foundation offers business loans, education loans, marriage loans, and health loans without any interest. People searching for Akhuwat loan apply online 2026, eligibility criteria, required documents, and application process can benefit from this program. The main goal of Akhuwat Foundation is to reduce poverty, promote self-employment, and empower deserving families across Pakistan. Due to its transparent process and zero-interest policy, Akhuwat Foundation interest-free loan 2026 is considered one of the best microfinance initiatives in the country.

Read complete details about Akhuwat Business Loan 2026 for small businesses and startups.https://akhuwatloanapply.org/

Fast Approvals

Quick and easy access to financial support for your needs.

Trusted by Thousands

Join a large community benefiting from our assistance programs.

No Hidden Fees

All support programs are transparent and fair with no extra charges.

Flexible Options

Customized support plans to suit personal or business needs.

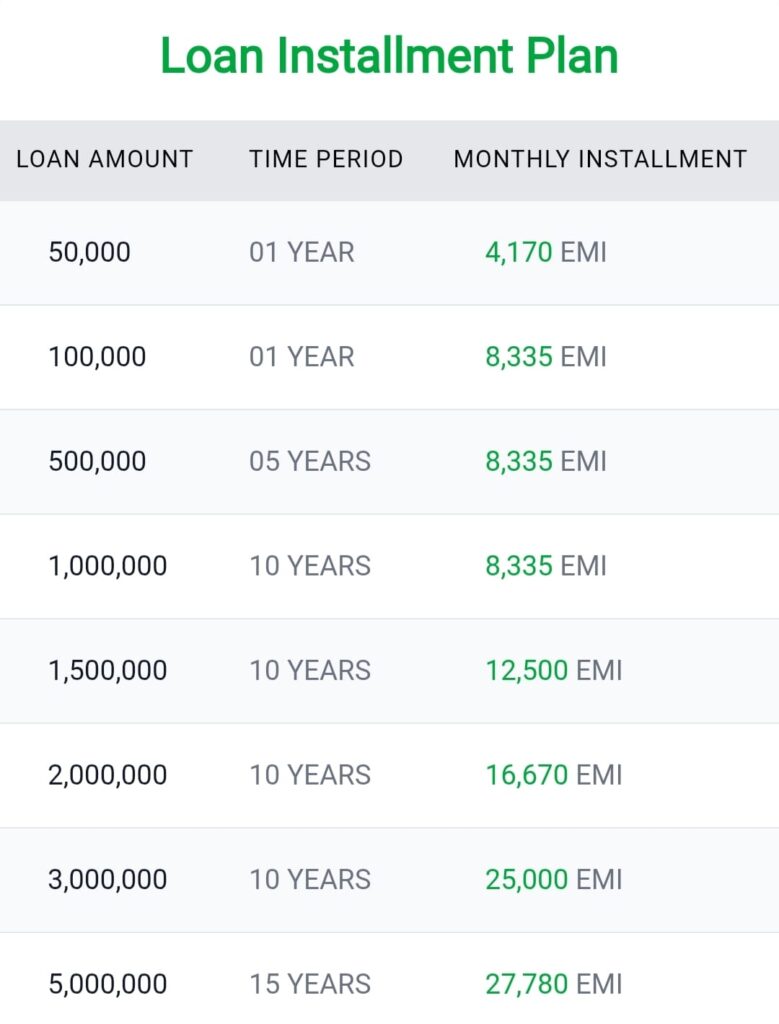

Rs 4,167 / month

1 Year

Rs 8,335 / month

1 Year

Rs 8,335 / month

2 Years

Rs 8,335 / month

5 Years

Rs 8,335 / month

10 Years

Rs 16,670 / month

10 Years

Rs 25,000 / month

10 Years

Rs 27,780 / month

15 Years

Akhuwat Loan Calculator

Interest-Free Loan Estimation

Loan Amount:

Repayment Period:

Monthly Installment:

Friendly Support

Our support team is always ready to guide you with clear and honest information regarding loan applications and verification.

Contact SupportEasy Registration

Simple and user-friendly registration process designed to save your time and avoid confusion.

Start RegistrationSecure & Transparent

We follow a transparent and secure system to ensure your data and information remain protected.

Learn MoreInterest-Free Loans

Shariah-compliant, interest-free financial assistance aimed at empowering individuals and families.

View DetailsAkhuwat Business Loan 2026

Akhuwat Business Loan 2026 is an interest-free financing program designed to support small businesses, startups, and self-employed individuals across Pakistan. Under its Qarz-e-Hasna business loan scheme, Akhuwat Foundation provides financial assistance without charging any interest, making it an ideal option for low-income entrepreneurs. People looking for Akhuwat business loan apply online 2026, eligibility criteria, required documents, and repayment details can benefit from this transparent and socially driven initiative. The program aims to reduce unemployment, encourage entrepreneurship, and strengthen the local economy by empowering individuals to start or expand their businesses through ethical and Shariah-compliant financing.

Akhuwat Business Loan 2026 is an interest-free financing program under the Akhuwat Loan 2026 initiative, designed to support small businesses, startups, and self-employed individuals across Pakistan. This Qarz-e-Hasna based business loan helps entrepreneurs start or expand their businesses without any interest burden. Through Akhuwat Business Loan 2026, applicants can achieve financial stability, create employment opportunities, and grow their businesses in a transparent and Shariah-compliant manner.

Akhuwat Car Loan

The Akhuwat Foundation offers car loans with interest rates beginning at just 1% per annum with up to 100% on-road financing.

Apply NowAkhuwat Student Loan

Assistance for students pursuing education in Pakistan or abroad with easy repayment options.

Apply NowLoan WhatsApp Helpline

Easy and fast loan approval through live chat with Akhuwat Loan Helpline agents.

Apply NowAkhuwat Home Loan 2026

Akhuwat Home Loan 2026 is an interest-free housing finance program under the Akhuwat Loan 2026 initiative, designed to help low-income families in Pakistan purchase, build, or renovate their homes. This Qarz-e-Hasna based home loan provides financial assistance without any interest, ensuring a transparent and Shariah-compliant process. Through Akhuwat Home Loan 2026, deserving individuals can fulfill their housing needs with dignity and long-term financial stability.

Easy Loan Support

A smooth and friendly loan support system designed to help you feel confident and stress-free.

Apply NowFast Approval

Quick verification and easy steps so you can move forward without delays or confusion.

Get StartedTrusted Assistance

A reliable and transparent system built to guide you with honesty and care.

Contact Us

Akhuwat Loan 2026 Scheme

Akhuwat foundation Loan Scheme 20256 program is a key part of the foundation’s work to create positive change in Pakistan’s economy and society. This program offers interest-free loans, which is rare in the microfinance industry worldwide. It aims to help people like small business owners, craftsmen, farmers, and women by giving them the money they need to achieve their goals and improve their lives.

Official Support Desk

Get complete guidance regarding loan application, verification process, and required documentation through our official support channels.

24/7 AssistanceSimple Application Process

Our application process is designed to be easy, transparent, and accessible for individuals from all backgrounds.

Easy & SecureInterest-Free Financing

We provide Shariah-compliant, interest-free loans aimed at empowering individuals and strengthening communities across Pakistan.

Trusted NationwideAdaptable and Convenient

To develop and sustain a social system based on mutual support where each individual lives a life full of respect and dignity.

Akhuwat Loan Helpline 0340-1009156

How to Apply for an Akhuwat Loan 2026

Applying for an Akhuwat Loan 2026 is a simple and transparent process designed to support deserving individuals across Pakistan. To apply, applicants must first understand the eligibility criteria and choose the loan category such as business, personal, or home loan under the Qarz-e-Hasna scheme. After preparing the required documents, applicants can visit the nearest Akhuwat branch or follow the official application guidance to submit their request. Akhuwat Loan 2026 focuses on interest-free financing, ensuring a fair and Shariah-compliant process that helps individuals improve their financial stability and quality of life.

Customer Support

Our dedicated support team is available to guide you through loan applications, registration, and verification.

Contact SupportLoan Assistance

Interest-free financial assistance for personal, business, and educational needs across Pakistan.

Apply NowTrusted Program

A Shariah-compliant, transparent, and nationally recognized loan initiative.

Learn MoreAkhuwat Loan Information

Interest-Free, Trust-Based & Shariah Compliant Support

You Are Eligible

Your basic eligibility can be verified easily. If requirements are fulfilled, you can apply for interest-free financing with confidence.

Check EligibilityLoan Amount Range

Financing is available from Rs 50,000 up to Rs 20,00,000+ depending on category and verification.

View DetailsSimple Documentation

CNIC, contact details and basic verification process is required. No complex paperwork.

Required DocumentsFast Process

After submission, verification starts quickly and you are contacted for next steps.

How It WorksSecure & Transparent

All information is handled securely with transparency and trust-based process.

Our CommitmentSupport & Guidance

Our team is available to guide you throughout registration and verification.

Contact SupportStep 1: Understand the Eligibility Criteria

Before applying, it’s important to understand the eligibility criteria set by Akhuwat. The foundation typically offers loans to:

- Individuals looking to start or expand a small business.

- People in need of financial assistance for education, healthcare, or improving living conditions.

- Applicants must show they need the loan and have a good plan to use it.

Step 2: Prepare Your Documentation

Akhuwat wants to make it easier for you to get a loan. You will need some documents for your loan application. This may include:

- A valid form of identification (such as a National ID card).

- Proof of residence or business location.

- A detailed business plan or description of how the loan will be used, demonstrating its viability and potential impact on your economic situation.

- Make sure your documents are up-to-date and correct to prevent any delays in your application.

Step 3: Visit an Akhuwat Branch or Contact Point

Find the closest Akhuwat branch or contact point in your area. Akhuwat has many offices in Pakistan, working with local mosques, churches, and community centers. Visiting in person lets you get information, ask questions, and learn about the foundation’s values.

Step 4: Attend an Orientation Session

Akhuwat regularly holds sessions for people interested in applying for loans. These sessions give information about the loan process, repayment terms, and success stories of past recipients. Going to a session is a great chance to learn about the foundation’s mission and how it can help with your financial needs and goals.

Step 5: Submit Your Loan Application

Once you have all the required information and documents, you can submit your loan application. Akhuwat staff will help you with the process to make sure your paperwork is complete and accurately shows your needs and ability to repay.

Step 6: Participate in the Community Verification Process

Akhuwat involves the community in verifying loan applications. They may visit your home or business and talk to community members to confirm your need and ability for the loan. This shows the foundation’s focus on community support and shared responsibility.

Step 7: Loan Approval and Disbursement

After your loan application is verified, it will be reviewed for approval. If approved, you will receive the loan in a group setting, highlighting the community’s support for everyone’s success.

Step 8: Repayments

Akhuwat loans have a clear repayment schedule and usually don’t have interest. When you pay back your loan, you not only fulfill your commitment but also help support other people in need through a revolving fund.

Frequently Asked Questions (FAQs)

Who is eligible for an Akhuwat loan?

Usually, people with low income who can’t use regular banks because they don’t have collateral or good credit can apply. The requirements for eligibility may change depending on the type of loan.